Cashflow Search and Rescue™

GrowthPath can quickly improve cashflow. We do this using our operational expertise at cashflow management, supplier and bank negotiations, faster forecasting and locking in to the key drivers of cashflow.

GrowthPath can quickly improve cashflow. We do this using our operational expertise at cashflow management, supplier and bank negotiations, faster forecasting and locking in to the key drivers of cashflow.

This expertise has mostly been gained in business turnarounds, when the pressure is on to quickly improve cashflow.

But healthy companies can also benefit from Cashflow Search and Rescue. Growth requires investment: in R&D, customer recruitment, new systems and processes or expansion. A business which can realise cash by improving cashflow management can at least partly fund its growth opportunities. A business which can self-fund opportunities will have the fastest response to opportunities. Plus, the inevitable cash-drain of growth will be minimised.

Better cashflow provides a critical ingredient for growth: the money and the speed to turn opportunities into new business

A third reason for cashflow optimisation is to improve the value of your business. All sophisticated valuation techniques are cash-based. Even if think your business is valued on profit multiples, a sophisticated investor is looking at your cashflow potential. By proving the best cashflow performance of your business, you will increase its value.

GrowthPath specialises in cashflow education and awareness for non-financial management and business owners: for example, try our free cashflow simulator Read more

Our years of operational experience with businesses as complex as large international manufacturers and as simple as child-care gives us a toolbox of important and proven techniques to extract cash from the business without harming important relationships (anyone can raise cash at the cost of lost customers and damaged supplier relationships).

{mooblock=Cashflow Search and Rescue: who is it for?}

For SMEs and small businesses which face cashflow problems or have cash flow optimisation as a major opportunity. Our techniques and experience are well suited to retail, manufacturing, wholesale and import/export businesses.

{/mooblock}

{mooblock=What's special about GrowthPath's Cashflow Search and Rescue™}

Experience shows that companies with under-performing cashflow have poor working capital discipline and unsatisfactory knowledge of contribution margins (variable costs). The two most common root-causes of cashflow under-performance are poor understanding of customers and late or hard-to-understand business information.

Fixing cashflow is 60% commercial experience and 40% technical experience. GrowthPath will bring proven analysis and benchmarking tools to quickly find the cashflow priorities. We are very commercial, and know that most cashflow problems are linked with supplier and customer relationships. This commercial experience is the reason why traditional external advisors struggle to help solve cashflow problems. Sometimes businesses have too much stock because of poor systems, but usually the reason is poor decisions about what customers want. With receivables, often the first mistake is deciding who to give credit to, and how to monitor the changing status of customers.

Cashflow performance is also linked to loans and other debt facilities. Many covenant tests are based on cashflow, and it's too easy to move to a downward spiral of reduced room in your debt facilities and poor or negative operational cashflow.

{/mooblock}

{mooblock=Benefits}

Better cashflow, better credibility with lenders and side-effects of a more efficient organisation, such as improved customer service levels.

{/mooblock}

{mooblock=Delivery of the service}

This service is delivered by Tim Richardson and Alan Rogers, CFOs with operational experience in Australia, Asia, North American and Europe in retail, wholesale and manufacturing.

GrowthPath will show you tool to manage cash better. Our experience will guide you in tips and advice specific to your business. And we'll teach your people the importance of cashflow through cashflow games and simulations, and insights into cashflow management.

{/mooblock}

For SMEs, better cash management brings a huge basket of benefits. It steers a business away from the rocks, and it lowers the cost of finance. Beyond that, cash is the necessary ingredient to invest in opportunities.

Sustainably improving the cash performance of a business is as much art as science, because supplier and customer relationships are involved.

If you raise cash simply by squeezing suppliers and cutting stock, you can do more harm than good. CFOs with operational experience, like Alan and Tim of GrowthPath, understand the interconnections that make cash management harder than it seems. Experienced CFOs also bring a toolkit of techniques and measurements. GrowthPath offers our clients a chance to benefit from both deep operational experience and a world-class blue-chip attitude to cash.

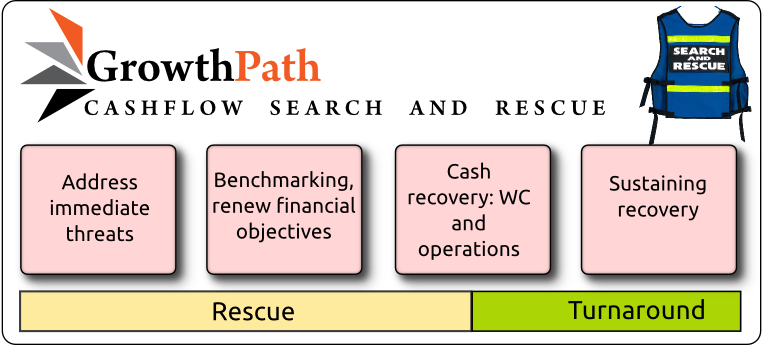

If a business is in financial stress, we recommend Cashflow Search and Rescue™. This four-step process starts with immediate business threats, and leads the business to a sustained recovery. A business which is looking to optimise cash and doesn't face immediate solvency concerns can start at the second step.