Business Consulting Services

GrowthPath offers four cores of business consulting services, for SME and small businesses.

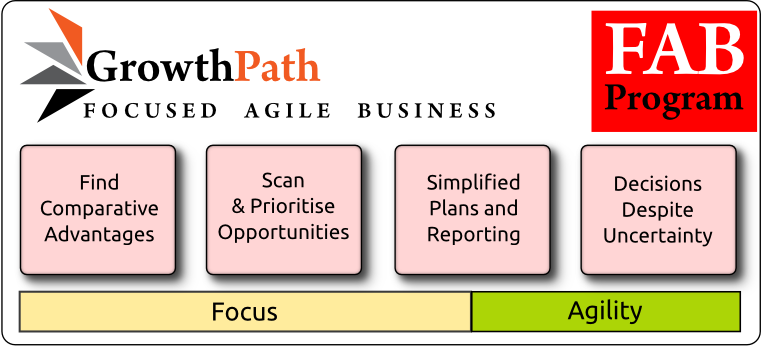

- Focused Agile Business (FAB) Program

- Cashflow Search and Rescue

- GrowthPath SAS: Short Assignment Services

- IVN Business Plan

FAB: Focused Agile Business Program

The FAB Program shows you how to exploit change to gain advantage over competitors.

The SME FAB program is a lightweight, rapid response business planning approach, using comparative advantage, simplified information and rapid decision making.

You can read more here: The Focused Agile Business Program

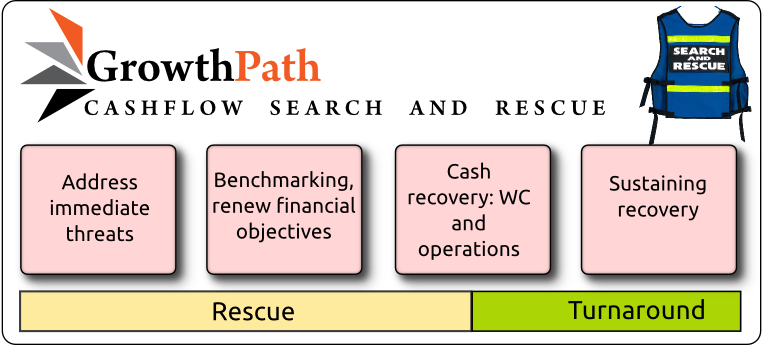

Cashflow Search and Rescue

Cashflow Search and Rescue

Experience shows most cashflow weaknesses are ultimately linked to information flows in the business and relationships with customers and suppliers. GrowthPath's consultants have major, real-world turnaround experience gained from senior finance management roles in small and medium-sized businesses.

{mooblock=Who is this service for?}

For businesses which face cashflow problems or have cash flow optimisation as their key improvement opportunity.

{/mooblock}

{mooblock=Key insights}

Experience shows that companies with under-performing cashflow have poor working capital discipline and unsatisfactory knowledge of contribution margins (variable costs). The two most common root-causes of cashflow under-performance are poor understanding of customers and late or hard-to-understand business information.

Fixing cashflow is 60% commercial experience and 40% technical experience. GrowthPath 's consultants have proven analysis and benchmarking tools to quickly find cashflow priorities: cashflow now.

Most cashflow problems are linked with supplier and customer relationships. This commercial experience is the reason why traditional external consultants and advisors struggle to solve cashflow problems sustainably. Yes, there are a lot of approaches that quickly bring cashflow: refinancing, factoring debtors, squeezing suppliers... but these approaches are often bandaid solutions.

Too much stock? Usually the reason is poor decisions about what customers want.

With receivables, often the first mistake is deciding who to give credit to, and how to monitor the changing status of customers.

Cashflow performance is also linked to loans and other debt facilities. Many covenant tests are based on cashflow, and it's too easy to move to a downward spiral of reduced room in your debt facilities and poor or negative operational cashflow.

{/mooblock}

{mooblock=Benefits}

Better cashflow, better credibility with lenders and side-effects of a more efficient organisation, such as improved customer service levels.

{/mooblock}

{mooblock=Delivery of the service}

This service is delivered by former CFOs with experience of firms in your sector.

{/mooblock}

Business Plans

GrowthPath's consultants use the IVN approach to build customised and convincing business plans; one of the first Australian companies to offer this approach. Read more about IVN Business Plans

GrowthPath SAS: Short Assignment Services

A set of specific, short term services where GrowthPath offers its business consulting expertise for small, fast projects. Suitable for smaller businesses.

|

|

|

|

|

|

{mooblock=Social media and online business planning}

Facebook has more than 10m users in Australia; that’s two thirds of the adult population. Many small businesses can take advantage.

Facebook has more than 10m users in Australia; that’s two thirds of the adult population. Many small businesses can take advantage.

An online presence and a database of customers will make your business worth more when the time comes to sell it or seek more funding.

Social media and the internet allow you to communicate to customers for much lower spend.

Social media can be very effective at getting customers talking about you.

Social media and the internet allow market research and insights that were previously beyond reach for small businesses.

Partly because of Facebook, Internet retailing is about to take off in Australia. Large, franchised retailers will mostly be losers, but there are plenty of ways smaller businesses can win. GrowthPath has the marketing and finance skills to assess the benefits offered to your business by social media and online business. {/mooblock}

{mooblock=Finance team: coaching and development}

Opportunities need fast decisions. Business results need good decisions. GrowthPath specialises in making sure your finance team is telling you what you need to know about where your profit comes from, how you are managing cash flow and the best ways to grow. Your finance support may be an in-house team, an external book-keeper and accountant, or a mix. GrowthPath will work with you and your finance support to give you better, more focused reporting and insights. Improvements will be in the speed of your reporting, and its relevance to the performance of your business. Read more:Improved SME decision support and Read more:A new mission for Finance{/mooblock}

Opportunities need fast decisions. Business results need good decisions. GrowthPath specialises in making sure your finance team is telling you what you need to know about where your profit comes from, how you are managing cash flow and the best ways to grow. Your finance support may be an in-house team, an external book-keeper and accountant, or a mix. GrowthPath will work with you and your finance support to give you better, more focused reporting and insights. Improvements will be in the speed of your reporting, and its relevance to the performance of your business. Read more:Improved SME decision support and Read more:A new mission for Finance{/mooblock}

Our CFOs On-call are highly experienced financial controllers and CFOs, with turnaround successes in retail, wholesale, distribution and manufacturing operations. Almost at a glance, your CFO On-call can see where you can optimise cash. There is a big difference between a business-focused approach and traditional accounting; this is an opportunity to consult with an experienced, commercial-oriented finance professional.

Our CFOs On-call are highly experienced financial controllers and CFOs, with turnaround successes in retail, wholesale, distribution and manufacturing operations. Almost at a glance, your CFO On-call can see where you can optimise cash. There is a big difference between a business-focused approach and traditional accounting; this is an opportunity to consult with an experienced, commercial-oriented finance professional.

If you are considering an investment or acquisition, good modelling can help you make the decision, and it can help you understand what risks are the most crucial to manage.

CFO On-call also build confidence with lenders by presenting high quality financial reports, forecasts and business plans.

When the time comes to sell your business, CFO On-call knows what business valuers will look for, and how to make your business worth more. Your CFO On-call has an extensive professional network opening doors to finance, banking, risk management and insurance.{/mooblock}

{mooblock=Win from the high AUD: outsource overseas!}

Did you know that there are broker websites that allow you to access skilled overseas people for low rates? With the strong AUD, you can access overseas skills for a fraction of local costs. This can save you money, and means you can afford projects previously out of reach. For example, you can dramatically reduce costs for graphic design, marketing materials and routine clerical tasks. However, using these sites effectively requires some techniques. The required skills are familiar to IT project managers: you need to define carefully what you need.{/mooblock}

Did you know that there are broker websites that allow you to access skilled overseas people for low rates? With the strong AUD, you can access overseas skills for a fraction of local costs. This can save you money, and means you can afford projects previously out of reach. For example, you can dramatically reduce costs for graphic design, marketing materials and routine clerical tasks. However, using these sites effectively requires some techniques. The required skills are familiar to IT project managers: you need to define carefully what you need.{/mooblock}

{mooblock=Cut costs and gain flexibility with the Cloud}

Many people know about app stores for their iPhone: at a click, get an app. That’s available for businesses too: it’s called cloud computing. Google Apps is a well known example. Accounting, backup, and marketing apps are available with a few clicks. They are charged per month at low rates, and require no servers, upgrades or installation at your end. They work on Macs, PCs and Linux, and often have Android, iPad and iPhone versions as well. Cloud apps don't care if you are working from home, the office, a client site or anywhere else with an internet connection. Software that used to cost thousand of dollars now becomes very affordable. There are some downsides, but cloud computing is very convincing.

Many people know about app stores for their iPhone: at a click, get an app. That’s available for businesses too: it’s called cloud computing. Google Apps is a well known example. Accounting, backup, and marketing apps are available with a few clicks. They are charged per month at low rates, and require no servers, upgrades or installation at your end. They work on Macs, PCs and Linux, and often have Android, iPad and iPhone versions as well. Cloud apps don't care if you are working from home, the office, a client site or anywhere else with an internet connection. Software that used to cost thousand of dollars now becomes very affordable. There are some downsides, but cloud computing is very convincing.

Cloud computing also gives your business amazing team-work tools like shared calendars, simultaneous, live edits of documents from any computer connected to the internet and huge email inboxes protected by extremely good anti-virus and anti-spam filters. Google docs does all this, and for fewer than 50 users, it’s free.

You save money, time and gain big-business ability to work securely and remotely from anywhere in the world. {/mooblock}

{mooblock=Finance system implementation and post-implementation}

M any small business who do accounting in-house use MYOB or Quickbooks, which are designed more for book-keeping than understanding business financials. MYOB is popular for good reasons, but it is easy to outgrow. Our principal consultant, Tim Richardson, is an expert in negotiating software pricing, implementing new systems and transferring data from MYOB to new systems, and more importantly, setting up new systems to make a real difference. Most of the cost of a new system is consulting costs; GrowthPath will slash these by choosing only what is necessary, negotiating and overseas outsourcing of some time-consuming steps.{/mooblock}

any small business who do accounting in-house use MYOB or Quickbooks, which are designed more for book-keeping than understanding business financials. MYOB is popular for good reasons, but it is easy to outgrow. Our principal consultant, Tim Richardson, is an expert in negotiating software pricing, implementing new systems and transferring data from MYOB to new systems, and more importantly, setting up new systems to make a real difference. Most of the cost of a new system is consulting costs; GrowthPath will slash these by choosing only what is necessary, negotiating and overseas outsourcing of some time-consuming steps.{/mooblock}